Traci Talks —

Traci Talks —

Striving to be even better.

2022 was a very exciting, eventful and challenging time. We kicked things off with exhilaration under a new field of membership as we converted from Community to Multiple Common Bond. Historically, our roots were planted in strong, intimate member relationships. Over the last few years, though, we lost our way and the value that we bring to the members we serve. It was time to reflect on ways we could improve.

Read the full message from TraciWe are committed this year to renewing our passion and dedication to our membership and will be displaying this in several ways. We are working with our local schools and businesses and listening to what they need and what value we can bring to their employees. We’re now offering an Employee/er Perks & Incentive Cooperative (EPIC) to our business partners. The goal of this cooperative is to help the business, as well as their employees. Our focus will be on financial education, a strong dedication to monitoring our rates, working to provide you with the most value from your membership, being accessible through numerous channels to better service you and several additional enhancements to our products and services.

Please know that your voice matters. We want to hear from you and would love for you to help us build a better financial institution that can service all of our members’ needs. The thing that didn’t change for us in 2022 was your loyalty, patience and ability to keep us relevant. We are truly humbled by your commitment and the trust that you place with us.

I thank you for being a member and hope you see the improvements we are trying to make for you. We are always looking for volunteers for our Supervisory Committee, Advisory Committee, and of course, Board of Directors. If you want to learn more about your credit union or to become an advocate for this exciting movement, I urge you to reach out and we’ll be glad to have you.

I look forward to a great 2023 and hope to keep you updated as we continue our journey together. “Welcome to Opportunity.”

—Traci Donahue, CEO

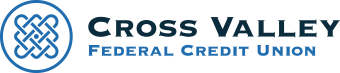

Close full message Community Care —

Community Care —

Crossing paths with Cross Valley FCU.

We’re more than just your financial resource. We’re your neighbors, your golf buddies, your fellow Rotary Club members and more. It’s no wonder we....

Youthful Hustle —

Youthful Hustle —

Opportunities for the future.

We really love it when our younger members take the initiative to control their financial destinies. It’s one of the reasons we offer a comprehensive...

We really love it when our younger members take the initiative to control their financial destinies. It’s one of the reasons we offer a comprehensive student loan program.

We work with our student members and their parents to help them borrow responsibly for college. We’ve already done much of the homework for you, so the loan applications process is positively painless.

The benefits to you are outstanding, including a choice between variable and fixed rates, repayment terms of 5/10/15 years, three different repayment options (fully deferred, interest only, or immediate repayment), loan amounts from $3,000 to $150,000, a 0.25% automatic clearinghouse (ACH) discount for auto debit payments on your loan, and the cosigner can be released after 36 on-time payments. Best of all, there are no fees to apply.

All roads lead to opportunity.

On the Calendar —

On the Calendar —

Head-to-head. Face-to-face.

It’s that time of year again. And on Monday, April 10th, we’ll be holding our 2023 Annual Meeting at our...

It’s that time of year again. And on Monday, April 10th, we’ll be holding our 2023 Annual Meeting at our main branch beginning at 5:30 p.m. We’ll be voting on two Board of Director positions, as well as presenting a review of 2022 and a preview of what we have in store for 2023.

Light refreshments will be served, and we plan to keep the meeting to 60 minutes or less. We invite you to come out and make your voice heard. To RSVP, just email Jill McGlynn at jmcglynn@crossvalleyfcu.org to let her know you’ll be attending.

SEG Spotlight —

SEG Spotlight —

Luzerne County Community College

Once upon a time, credit unions were specifically associated with a single workplace or organization...

Once upon a time, credit unions were specifically associated with a single workplace or organization. It was an opportunity for these members to pull their resources together to help each other financially. Today, many credit unions, like Cross Valley FCU, work with a variety of organizations instead of a single one. And they’re known as Select Employee Groups, or SEGs.

Cross Valley works with many SEGs in our community, and we’d like to take this opportunity to introduce you to one of them—the students and the alumni association of Luzerne County Community College (LCCC). LCCC officially came into being on December 15, 1965, and began formal operations on October 2, 1967, initially offering 11 programs. According to the LCCC Alumni Association, they now have more than 32,000 degree-bearing alumni. The school has also grown to offer more than 100 academic credit programs and several non-credit training programs.

“The original CEO and president of Cross Valley FCU, Len Shimko, was a graduate from our first graduating class in 1969," says Bonnie Lauer, Director of Alumni Relations for LCCC. "He was active in our Alumni Association for many years, then served on our Foundation Board. His successor, Traci Donahue, is also on the Foundation Board and continues that relationship. That’s why our connection is as strong as it is.”

The LCCC Students and their Alumni Association chose to partner with Cross Valley so that they could offer their members opportunities to reach their financial goals. Through our EPIC (Employee Perks and Incentive Cooperative) program, students and alumni now have a unique partnership that offers financial wellness benefits and support.

“Being a SEG member, we’re doing more cooperatively with the credit union," says Lauer. "They promote our events, and we promote the credit union to our graduates, as well as our staff. They have so many services for our community, and they sponsor so many of our events. It’s just a great working partnership we have together.”

Fraud Watch —

Fraud Watch —

Out-smarting the scammers

Scammers put a lot of effort into finding ways to trick people into giving up their personal information. Once the scammer has that info, they can use...

Scammers put a lot of effort into finding ways to trick people into giving up their personal information. Once the scammer has that info, they can use it in a variety of ways to create a financial gain for themselves at the expense of unsuspecting consumers.

Some of the latest scams include fake crypto investments and student loan forgiveness solicitations; damaged used cars selling for sky-high prices; Google Voice verification code requests; Zelle, Venmo and Cash App scams; work-from-home offers of employment; Amazon imposter emails, calls and texts; fake charity solicitations; and tech support scams that provide remote access to your computer.

First and foremost, never give personal information out over the phone or by email. If someone claiming to be from Cross Valley calls about your account, hang up immediately and call us back. We’ll be able to verify if the request is valid, although we would never ask for sensitive information by phone or unsecured email.

Second, phone calls and emails from these scammers are very authentic looking/sounding. But if something seems too good to be true, it probably is. Always check the email address or phone number of the person contacting you. Again, if you have any doubts, stop the transaction with the potential scammer and get in touch with the business or entity directly to see if there is a legitimate problem.

We’ll be using this space in future newsletters to pinpoint specific scams and how to avoid them, or what you should do if you have already fallen for one. As your financial wellness partner, we don’t want anything to happen to your hard-earned credit score or your identity.

Stay safe out there.

Good Financial Health —

Good Financial Health —

No hassle financial advice.

When you hear the phrase Certified Financial Planner (CFP), do you cringe a little? Chances are good that you or someone you know has been...

When you hear the phrase Certified Financial Planner, do you cringe a little? Chances are good that you or someone you know has been contacted out of the blue by a brokerage firm promising to make your/their financial future bright. Then comes the string of sales calls trying to get you to invest in something you may not even fully understand.

That’s not the experience you’ll have with our Certified Financial Planners. First of all, you’re already a member, and they already know you and will get to know you even better—to fully understand your current and ongoing challenges and your short- and long-term financial goals.

Their mission is to look at your financial well-being from a holistic point of view so they can make recommendations on all opportunities that can improve your financial situation—both current and future. And you won’t experience any high-pressure sales tactics, because our financial planners aren’t here to sell you anything. They’re here to listen. What a concept.

Upcoming Holiday Closings: