The right car matters. The right car payment matters more.

Auto loans (and payments) designed for real life.

- Competitive rates

- No payments for 90 days¹

- Free CARFAX® Report²

- Available GAP Plus³

What 90 days of no payments looks like:

Now through MONTHHERE, when you close on an auto loan or refinance one from another lender, you'll automatically get a 90-day break from payemnts.

$780* in your pocket

That covers a full trip to the grocery store and some additional funds for the weekend ahead.

$1,560* in your pocket

Toss some of that into savings, take the family out to dinner and a movie and fill up the grocery cart. Now we're talking.

$2,340* in your pocket

Did someone say family vacation?

Purchases or refinancing made easy.

Whether you’re looking at dealerships, casually shopping around or are ready to finally refinance your existing loan and benefit from the savings, Cross Valley’s auto loan process is simple. And we’re here to guide you through the entire process.

Easily apply online

Simply select Auto Loans from our loan categories, complete the application online or by calling us at (570) 823-6836.

If you don't already have a vehicle in mind, you can easily get pre-approved so you know what you're working with.

We'll be in touch

Once you've applied, give us 24 hours and a Cross Valley team member will reach out to discuss the next steps.

We'll be there with you every step of the way!

Finalize your financing

Once everything's ready, close on your loan 100% online or come into any branch location.

Cross Valley can even transfer funds directly to the dealership.

Peace of mind + Protection

Protect yourself from the unexpected with affordable options designed to keep you covered if your vehicle is ever totaled or stolen.

Free CARFAX Report²

Before you finalize your vehicle, take a moment for peace of mind with a free CARFAX® report². It helps you understand a car's history—accidents, ownership, and service records—so there are no surprises later. It's a simple step that provides confidence in the decision you're about to make.

GAP Plus³

GAP Plus does everything standard GAP does, and gives you extra help getting back on the road. Along with paying off the loan gap, it includes a $1,000 bonus credit³ toward your next vehicle, making replacing your car easier and less stressful.

What will my monthly payments look like?

This calculator is for informational purposes only and is not a final, binding notification of what your actual monthly payment will be.

No payments for the first 90 days means your first payment is due 90 days after your loan is funded. Interest starts accruing immediately. All loans subject to credit approval. Offer subject to change without notice. Credit union membership required.

CARFAX Vehicle History Report™ offered free of charge with vehicle loans closed through Cross Valley Federal Credit Union from (date — date). Does not apply to existing Cross Valley Federal Credit Union vehicle loans. Offer subject to change without notice. Credit union membership required.

GAP Plus protection is optional and not required to obtain a loan. It helps cover the difference between your vehicle’s insurance settlement (actual cash value) and your remaining loan balance if your vehicle is declared a total loss due to theft or accident. GAP Plus protection does not replace auto insurance and may have coverage limits, exclusions, and maximum benefit amounts. Benefits may not apply to late payments, past-due amounts, extended warranties, service contracts, or carryover balances from a previous loan. Terms, eligibility, and benefits vary by state and provider—please review your contract for full details. Credit union membership required. Offer and availability subject to change without notice.

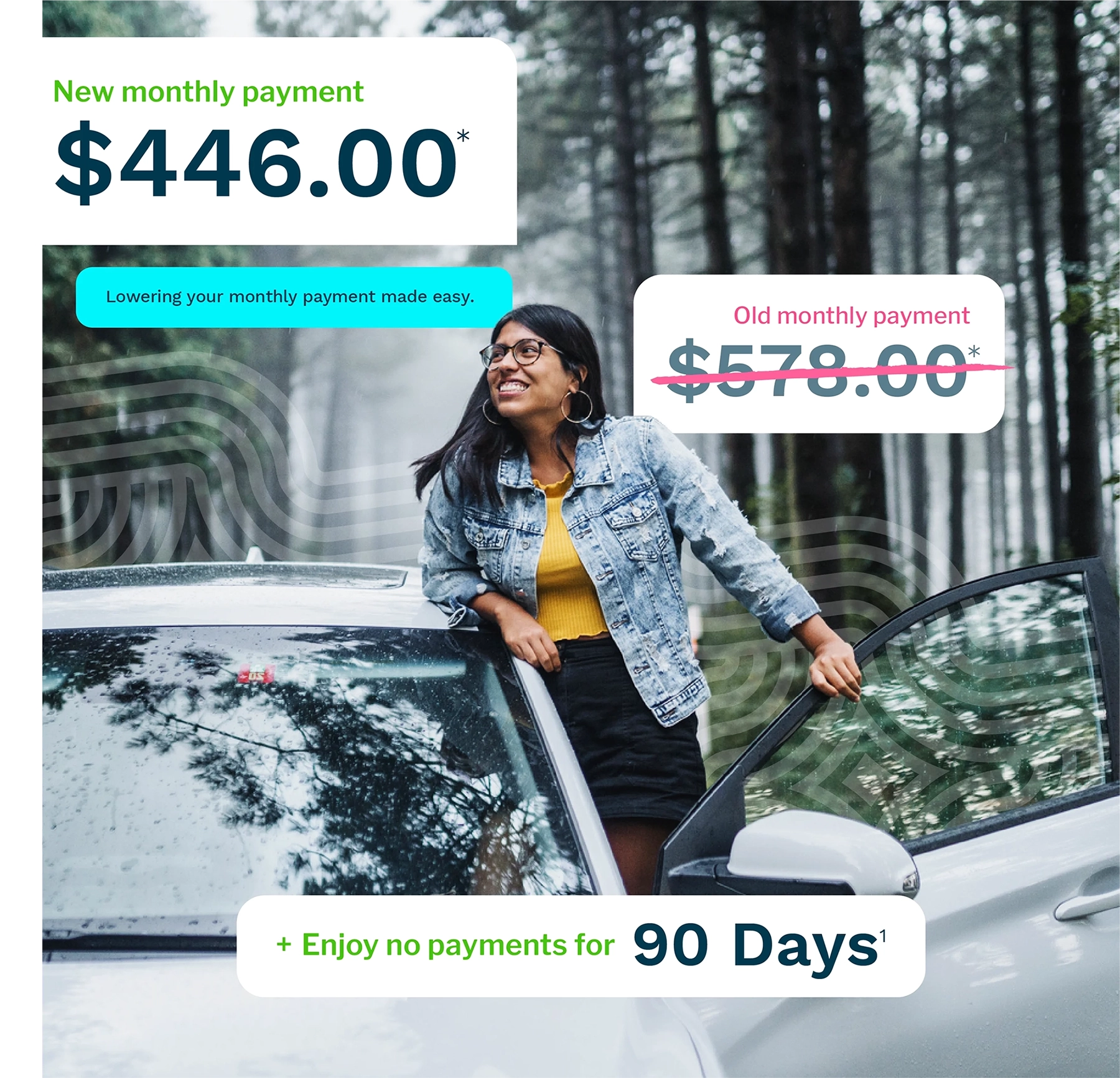

All figures and car payment amounts are used for comparison purposes only and are based on the average new car and used car monthly payment in the United States as of January 2026.